| Overview | Capital Partners Securities Co., Ltd. |

|---|---|

| Registration Number | Registered with the Director of the Kanto Local Finance Bureau of the Ministry of Finance No.62 |

| President | Takehiko Kutsuzawa |

| Headquarters & Tokyo Office | Shikoku Building, 1-13-7 Uchikanda, Chiyoda-ku, Tokyo 101-0047 |

| Tel: 81-3-3518-9300 Fax: 81-3-4543-1052 | |

| Osaka Branch Office | Shin-Osaka Doi Building, 7-5-25 Nishinakajima, Yodogawa-ku, Osaka 532-0011 |

| Tel: 81-6-6232-8370 Fax: 81-6-6232-8379 | |

| URL | http://www.capital.co.jp |

| Date of Establishment | December 27, 1999 |

| Capital | JPY 1 billion |

| Number of Employees | 27(as of October 1, 2024) |

| Association | ・A member of Japan Securities Dealers Association ・A member of Type II Financial Instruments Firms Association |

| Investor Protection | A member of Japan Investors Protection Foundation |

| Auditor | SKIP Audit Corporation |

| Attorney | Hashidate Law Office |

We are dedicated to provide innovative financial solutions to our valued clients.

We are pursuing utmost professionalism with passion and alert mind.

We always think from clients’ perspective and strive for creating maximal satisfaction to our clients.

One of the strengths of Capital Partners Securities (CPS) is our solid international network that enables us to provide a globally diversified investment.

We at CPS have been developing businesses in the Asian region for about 20 years. Based on the cooperation with local partners and companies and making full use of our research capabilities built on our distinctive network, we provide our clients with prospective investment opportunities in Asia.

While taking advantage of these strengths, we will always think from the perspective of clients and conduct our business having customer-oriented business operations in mind. We have three basic credos that all officers and employees are expected to follow, i.e., "Value creation with point of difference”, "Pride of professionals" and "Happy smiles on clients’ face". In line with such corporate philosophy, the whole staff of CPS are fully committed to making every endeavor to maximize customers satisfaction.

As we move forward, your continued cooperation and steadfast support would be much appreciated.

Takehiko Kutsuzawa

President & Representative Director

Capital Partners Securities Co., Ltd.

As of June 24, 2025

As of March 1, 2025

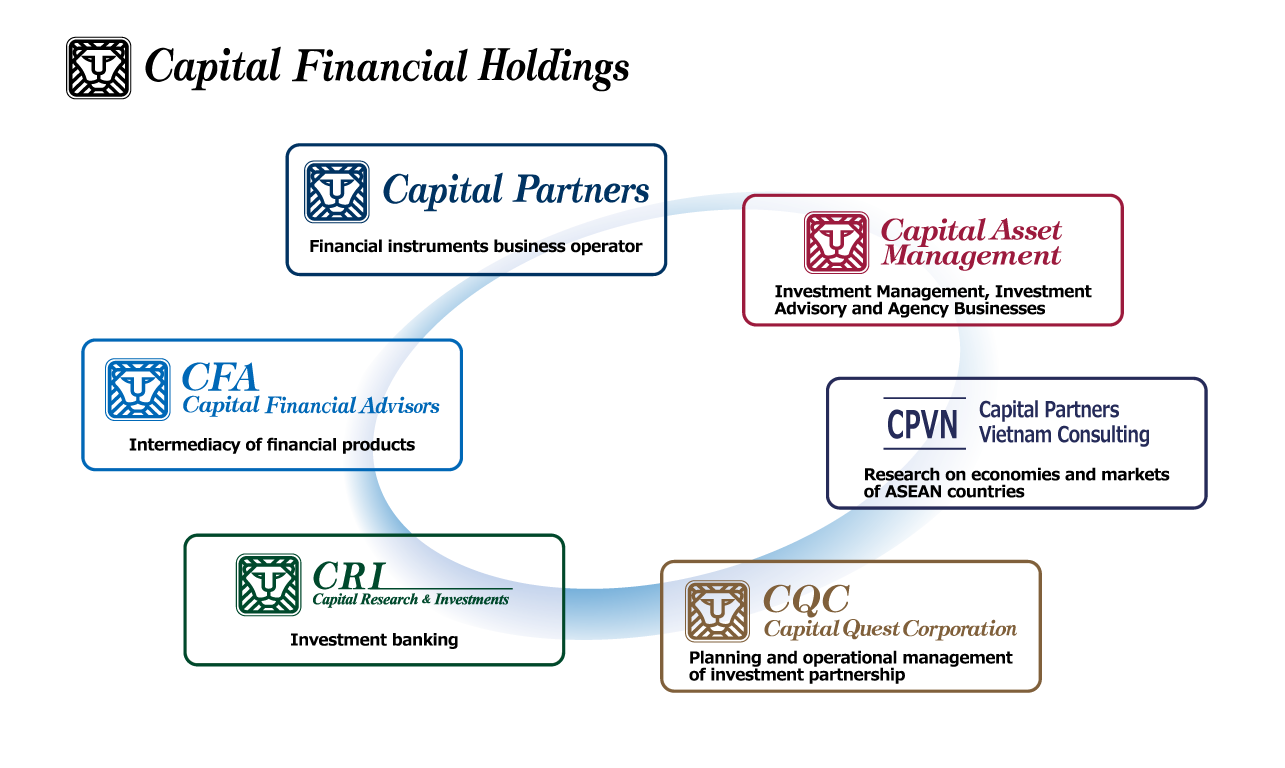

| October 2018 | CPS and Capital Asset Management Co., Ltd. established a joint holding company (named Capital Financial Holdings, Ltd.) by way of Joint Share Transfer. |

|---|---|

| February 2016 | The head office was relocated to 1-13-7 Uchikanda, Chiyoda-ku, Tokyo. |

| August 2014 | CPS's capital was reduced to JPY 1billion. |

| December 2012 | CPS's captal was increased to JPY 2.95 billion through a third-party allotment. |

| September 2012 | Merchant Banking Division was moved to 3-13-11 Nihonbashi, and Securities Business Division was moved to 1-13-7 Uchikanda, Chiyoda-ku. |

| March 2012 | Aiming to strengthen each business division, two business divisions were formed, i.e. Merchant Banking Division specialized in M As and Securities Business Division dealing with securities brokerage businesses. |

| November 2011 | CPS purchased additional stocks of Capital Partners Vietnam Consulting and made it a local subsidiary. |

| October 2010 | CPS purchased the shares of Capital Partners Vietnam Consulting. |

| February 2010 | Capital Partners Asset Management merged with and Plaza Capital Management, and the new company was named as Capital Asset Management. |

| January 2010 | CPS joined Global Alliance Partners as the only Japanese member. |

| October 2009 | CPS purchased Plaza Capital Management and made it its wholly owned subsidiary. |

| October 2009 | The name of Humint Asset Management was changed to Capital Partners Asset Management. |

| August 2009 | CPS's capital was reduced to 2.85 billion. |

| July 2009 | CPS purchased Humint Asset Management and made it its wholly owned subsidiary. |

| June 2009 | CPS acquired a license to be an agent for SECOM and began dealing with cancer insurance. |

| October 2008 | CPS acquired a license to be an agent for Aioi Insurance and started to deal with comprehensive health insurance with a care protection rider called "Care-Best with lump-sum payments". |

| June 2008 | CPS started to handle individual stocks listed in the Vietnam’s markets. |

| September 2007 | A branch office was opened in Fukuoka. |

| August 2007 | A branch office was opened in Osaka. |

| December 2004 | CPS's capital was increased to JPY 4.75 billion through a third-party allotment. |

| November 2003 | The head office was relocated to 3-2-2 Nihonbashi, Chuo-ku, Tokyo. |

| May 2003 | Capital Partner Holdings Co., Ltd. acquired 100% shares of Prudential Financial Advisors Securities Co. Ltd. from U.S. Prudential Financial. The corporate name was changed to Capital Partners Securities Co., Ltd., and become operational under the new management. |

As of October 1, 2024

Click to enlarge

We at Capital Partners recognize the importance of cultural exchanges between emerging countries and Japan, and we have been supporting the activities of the Japan Vietnam Cultural Association (JVCA).

Japan Vietnam Cultural Association

www.jvca.or.jp